Tax II

Short Description

Earn a CIBA Certificate of Completion in Tax II for part completion of the designation.

About the module

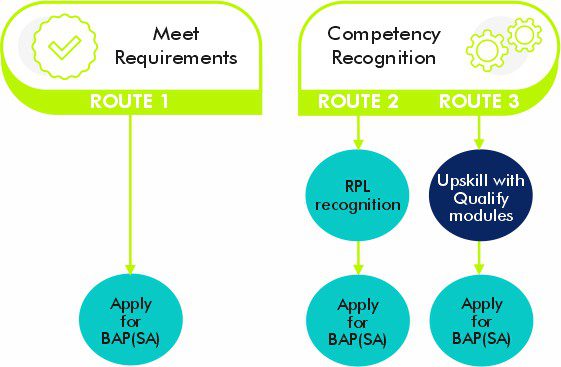

The module forms part of the core knowledge categories of an accountant in practice, and upskilling requirements to apply as a Business-Accountant-in-Practice (SA) via CIBA’s Route 3. Read more here.

Module purpose

To provide students with appropriate knowledge regarding, direct and indirect taxation. Furthermore, students will be able to identify whether a transaction is subject to value added

tax, income tax, capital gains tax, donations tax and estate duty tax. Students will be able to calculate various forms of tax liabilities.

Module Outcomes

- Introduction to Taxation

- Value Added Tax

- Business entities

- Capital gain tax

- Individuals

- Provisional tax

- Trusts

- Donations tax

- Estate duty

Module Assessment Criteria

The above outcomes required in this module will be presented and assessed in the following format:

- Prescribed electronic textbooks with assessments

Requirements

- BCom degree and Higher Diploma in Accounting

- Approval from CIBA membership department to enroll (terms and conditions apply). Simply send an email to membership@myciba.org requesting to enroll in the Qualify courses providing the following documentation:

- CV

- Identity document

- Academic Qualification

- Academic Record

- Completion of Articles or RPL Form (request from membership@myciba.org)

Accreditation

The Southern African Institute for Business Accountants NPC is a professional body accredited by South African Qualifications Authority (SAQA) – Professional Body ID 874.

On successful completion of the final exam you will receive a certificate of completion issued by CIBA that serves as evidence of competency in the analysis, preparation and reporting of financial statements in accordance with International Standards and Local Regulations for legal entities, related and consolidated groups. The certificate is issued in terms of the National Policy for the Implementation of the Recognition of Prior Learning as authorized by SAQA and is regarded by CIBA as meeting the competency criteria approved by SAQA for admission as a BAP(SA).